Nifty & Sensex rally managed to achieve the gap based target around 7972. We have seen some correction since then and we are trading around 7900. We see this correction as short term in nature which is good considering that Nifty has traveled from 7585 to 7977 very quickly. This is a rally of close to 400 points in 7 sessions. We see this rally as wave (i) within a developing wave 3.This rally can be used to measure the expected magnitude of the next rally in the stock market. We elaborate on this magnitude later.

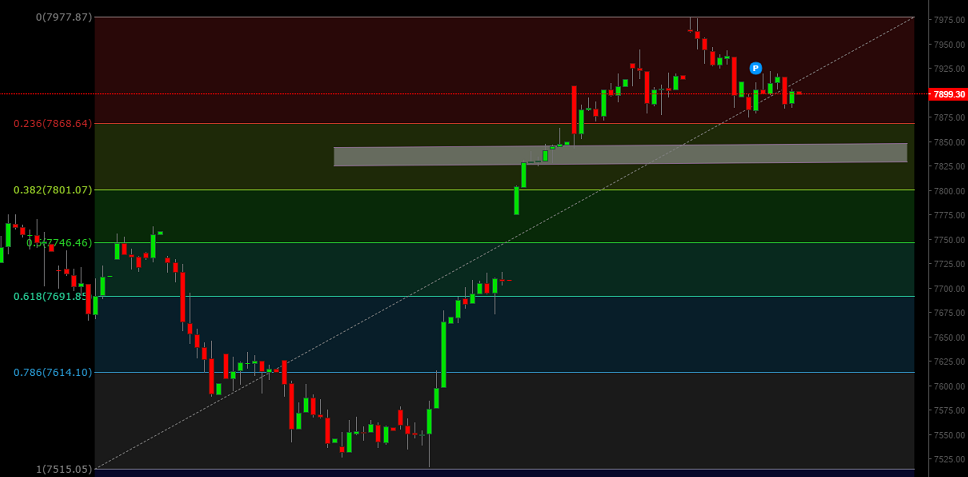

The current fall from 7977 should be seen as minor wave (ii) correction within wave 3 as per our most likely scenario. Such corrections typically develop as a zig-zag, and often retrace up to the range of minor degree wave (iv) of lower degree. The target zone as per this would be 7828-7850. Also it is not uncommon to see prices carry to 38.2% retracement levels. This level comes close to 7802. Usually in order to get more precise turning points we use the price structure of the correction, but in this case so far the price structure is unclear as it has probably not fully developed. It seems we are not involving in a typical zig zag wave (ii) correction, but in fact the correction has taken a more complex form. Based on this we see a reasonable chance that prices may still carry to around 7828-7850 zone. Chart below:

Once we complete this correction which may happen as soon as this week, we may be in for another major rally very soon. As per Elliott wave theory, the magnitude of next rally in Nifty/ Sensex may easily be 1.5 to 1.618 times the magnitude current rally. If it develops an extension (and it easily might considering this is wave (iii) within wave 3), it may very well be 2.618 times in magnitude. To put in numbers, the magnitude of next rally in Nifty may be of 600 to 650 points (2250-2427 points for sensex), possibly higher. This should easily take us into 8000s for Nifty and 28000-29000 range for Sensex.

While it would be great if we could capture the turning point more precisely, we still have a lot to gain even if we got into the trend once it has gathered some momentum. A high probability sign of this would be markets breaking their recent highs of 7977 for Nifty & 26080 for Sensex. A break of these levels would be a sure sign for our expectations to materialize, we may issue more precise price targets, once we see a bottom is in place.