Stock Market Courses for All Levels

Investment Philosophy

Our Analysis Framework

Fundamentals

Objective Past Performance

Technicals

Elliott Wave & More

News

Factoring Sentiment

Intermarket Confluence

Actionable Recommendation

Disclaimer

The financial recommendations expressed on our blogs are without consideration. While all our views are expressed on a best effort basis, investing by very nature is a risky venture with a potential for loss. The investor should take into consideration his own financial situation before executing any trade. IndianInsight.com is not responsible for any losses arising out of executing its views by the investor. Also, it would be fair to assume that if there is any recommendation on the blog, it is likely that author could have a corresponding position in the markets that may be affected by price movement in the security. We only use publicly available information for our analysis and the views expressed on this website should not be considered a “stock tip”. We are currently not registered with SEBI and all articles shared here are for educational purposes only

Services

Education

We provide quality financial education based on our experience to ensure their relevance to real world application

Market Analysis

We share free insights into various financial markets including various indices, currencies, real estate, interest rates and the economy

Latest News

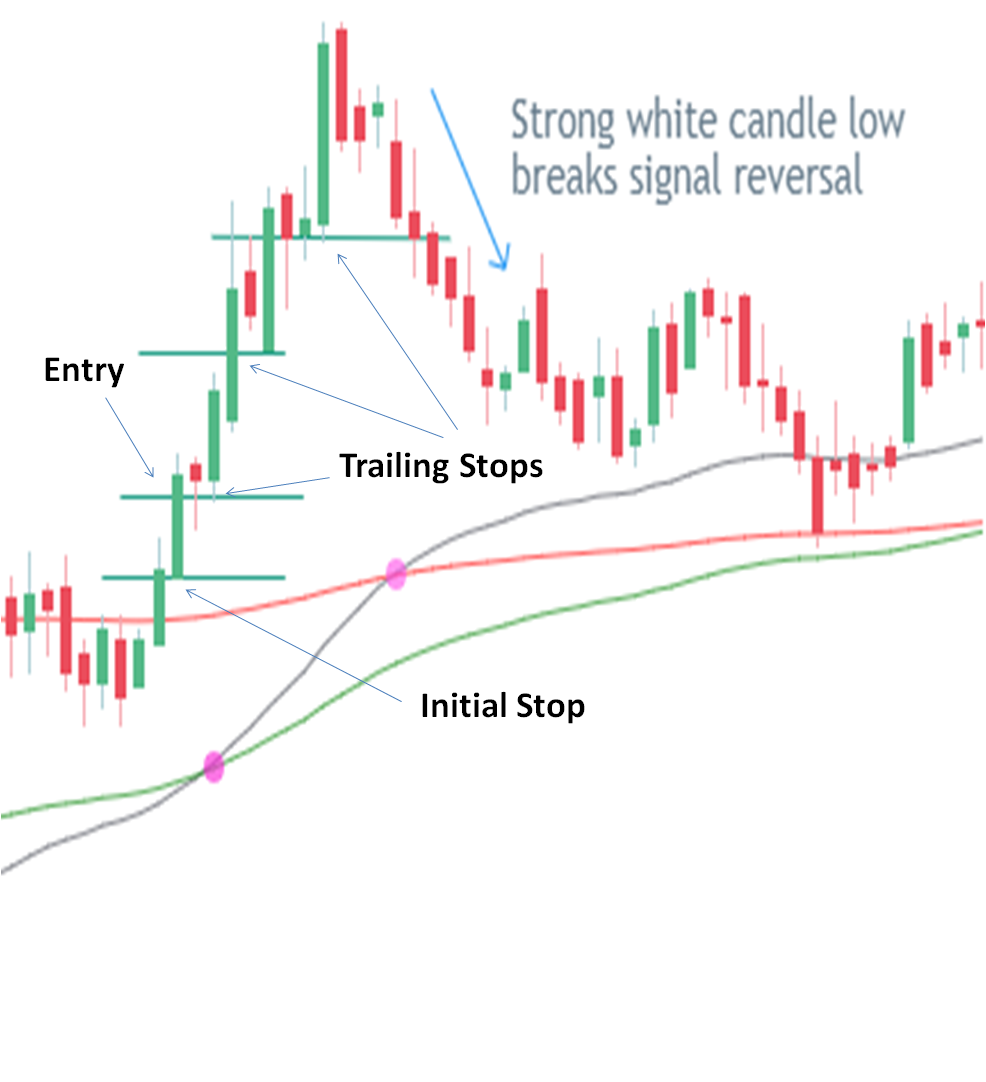

Marubozu Candle – How to trade

Marubozu candles are simple, easy to spot candles that indicate strong move in either direction (up or down). In this post I’m going to cover the details about Marubozu candles and more generally about strong white and black candles. I will share: Basics of Marubozu Candles (White & Black) Different […]

Nifty Update

The failed potential triangle (per last post), led to a swift fall in markets. The triangle pattern as such is a great price pattern which provides specific price targets & stop loss price. However the relatively under-rated feature of this pattern is how often the ‘reverse trades’ on break of stop losses […]

Nifty Elliott Wave Count Update

Nifty has broadly performed in line with our expectations outlined before the election results were announced. The 11900-12500 zone mentioned in our last post has been a strong resistance zone. Based on the price action since, we believe it is very likely that this zone will continue to remain a […]

Nifty implied 2019 elections India predictions

Since our last post (which was quite a while back), Nifty has finally managed to hit the 11300 mark. Indian markets have spent quite a bit of time in creating a base before breaking above the 11000 high and the movement since has been swift. The price action on the […]

Value Investing Myths – Video from Value Investing Course

Value Investing Video In the following video I discuss some value investing myths. You can access the complete value investing course here. Value Investing Video Transcript Now in this video I am going to share some general thoughts surrounding value investing. Even if you are new to value investing chances […]

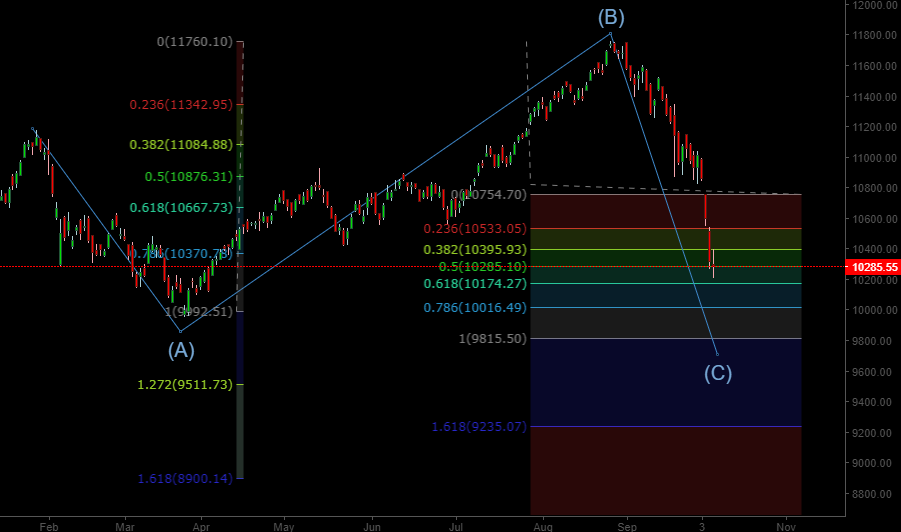

Nifty Update

Nifty crashed substantially from close to the 11000 level mentioned in the last report. Our primary case has been that the rise leading up to 11000 was part of an A-B-C (possibly flat) correction. However the extra ‘legs’ that developed left other interpretations open. Chart Below: The subsequent decline had been […]

Nifty Update

Nifty seems to continue to move as part of a larger A-B-C correction (weekly chart below): Nifty formed a low around 10000 levels on 26th October and posted a nice up move. We are seeing this up-move as part of a correction. As long as we don’t break above the 10710 level, […]

Nifty Update

Nifty broke through the crucial 10815 level by the way of a gap formation and very quickly took out the 10557 level (mentioned in our last report) . The subsequent fall has been quite swift. This fall now seems to be part of an A-B-C irregular flat correction. Chart Below: The […]

Nifty Update

In spite of sharp fall in Nifty neither of our elliott wave counts can be completely ruled out. The price substructure right now also seems to be insufficient to take a conclusive view in either direction. In such scenarios the only option is to wait for important levels (mentioned below) […]

Nifty Update

Nifty has continued to rally in line with the alternate scenario we outlined in our last post. The gap area of 11185-11210 proved to be decisive in keeping us on the right side of the markets and prevented us from getting bearish in anticipation of our base count outlook at […]