Nifty’s sharp fall on Brexit outcome took support at 7936. It managed to stay over the crucial support of 7896 mentioned in our Nifty medium term wave count report. This report mentions 7896/7715 as crucial support in determining our most preferred wave count. We will continue to watch these levels closely.

Post Brexit Nifty has managed some sort of a rally, but momentum wise this rally has been tepid. Chart Below:

Furthermore the price crash post brexit has meant that the 5th wave up move we were looking for has ended in a truncation. Truncated waves indicate a sign of weakness ahead. Rallies that develop as part of wave 3 are too strong for truncation to develop. This casts doubt on our top priority wave count which assumes Nifty / Sensex to be developing a wave 3. It has also raised odds that the rally since late Feb/ early March lows may be an X wave. At this point though the markets have not indicated conclusively either way. While we cannot rule out another rally towards 8300, this rally if it develops may be a part of an expanding diagonal triangle, which would again imply a substantial fall post pattern completion.

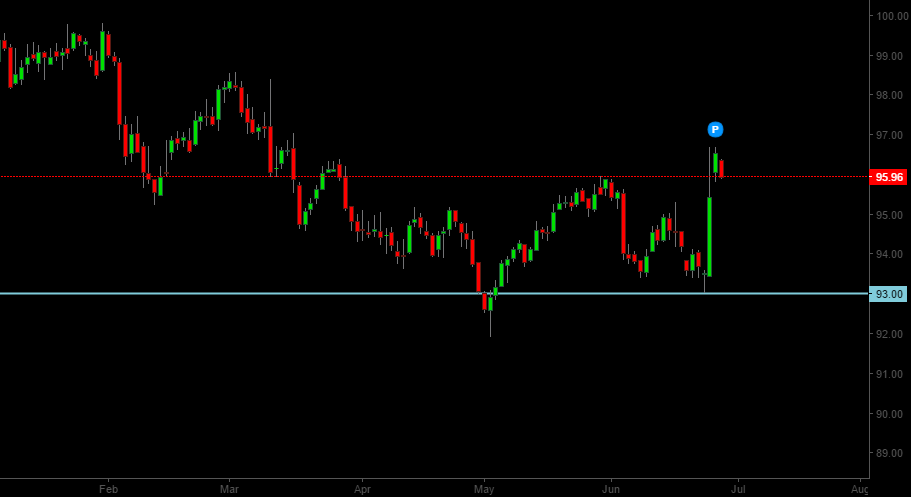

Meanwhile Dollar Index has posted a major rally as per the scenario outlined in our pre Brexit post on the FX markets. In light of this the low of around 93 on dollar index is very likely to be an important low. We anticipate it is highly likely that this rally in Dollar Index might continue and it it materializes we may see the deflation theme coming back world over. In light of this it would be prudent to avoid metal stocks completely. Dollar Index chart below:

Meanwhile Brexit prompted a pop in Gold prices, which meant our initial 2016 target for gold of $1330 was hit. Gold made a high of $1365 and has since corrected quite a bit. We still believe it is highly likely that Gold will meet our revised 2016 target of $1410-$1430. It is very important to not get carried away with development in Gold prices as this rally from late 2015 lows is actually a part of A-B-C correction. Hence it would be a mistake to assume this as beginning of a bull market in Gold. It is very likely that the rally in Dollar index is too strong for Gold prices to sustain their momentum substantially higher than our target zone of $1410-$1430.

In light of volatility and active developments across various markets, we think that while it is still possible for Nifty to regain 8300, this rally (if it materializes) should not be used to build new positions. The price action has shifted the odds that we may see a substantial decline and we wait to see if Nifty immediately attempts a test of 7896/7715 levels. The short term key support for Nifty is at 8038 level, a break of which may see an immediate test of 7896.

One thought on “Nifty Post Brexit Strategy”

Comments are closed.

Sir i think that the wave which came from 9119 to 6825 was already complex in correction so then this wave which started from 6825 should be an impulse….this is my own view and i can be wrong also….