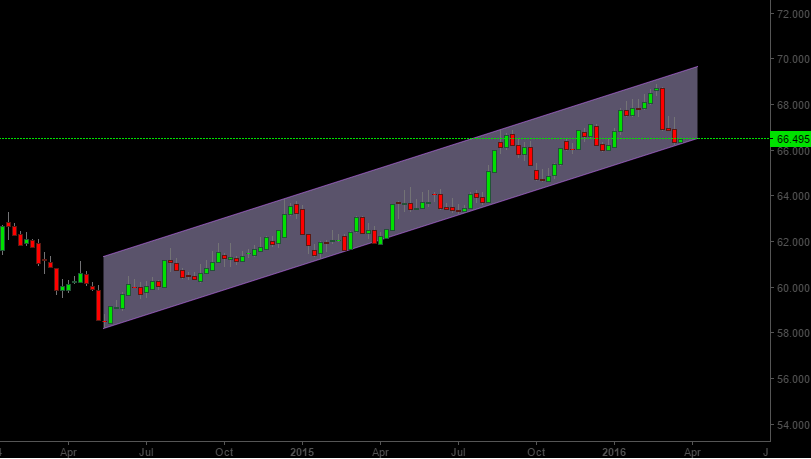

USDINR currency pair has been trading in a channel since May 2014. This channel has managed to hold on for quite a bit of time now. The latest peak created on 22-Feb failed to test the upper trend line of the channel, which is generally an indicator of weakening trend. Currently the pair is trading close to the lower end of the trend channel and a break of this trend channel may mark beginning of multi-month rally in INR. What is not supportive though is the current state of the stock market, which is slowly and gradually moving towards our target zone of 7700-7750. There is a possibility that the stock market may enter some kind of a correction, which would not be supportive of a break of this trend channel. While correlations between markets make and break so it is still possible that INR may rally in a falling market (if it develops). However it would still be prudent to wait for a break of the crucial zone of 65.83-65.93 to confirm a change in medium term trend.

On the upside 66.87-66.90 remains a key zone which would be first indicator another rally in USDINR currency pair. In light of this the current weekly close is going to be very important in determining further trend of the currency pair.

One thought on “Crucial Week for USDINR”

Comments are closed.