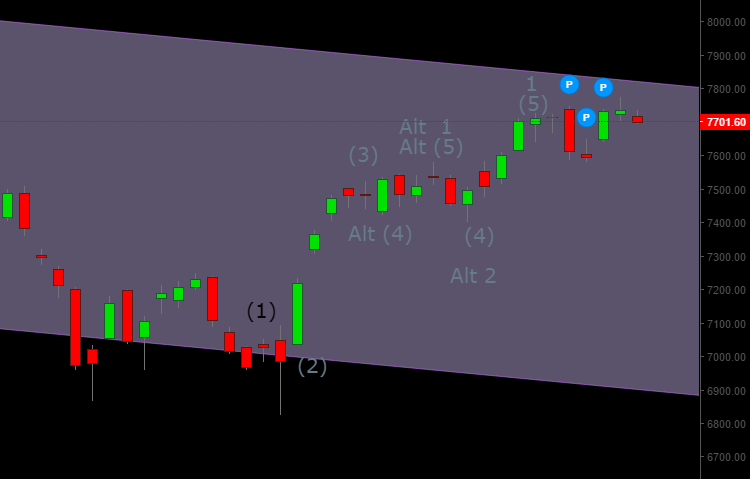

Nifty & BSE Sensex have encountered resistance at important levels. We mentioned in our last post how 7745 & ultimately 7800-7820 (upper end of the trend channel) may be important levels for Nifty.

We saw markets crash sharply from 7745 & equally sharp rally back, markets pulled back from 7777 levels. The correction of around 168 points was amplitude wise similar to previous corrections. Ideally we should have seen a much deeper correction. But again this is more a guiding principle than a rule.

While the long term story remains in tact. Currently the short term market structure is not so clear. In light of this we should wait to see how the price action resolves near the upper end of our trend channel. We believe a break of this trend channel would likely trigger only on a major up move. This breakout should ideally be part of a very strong move.

How the price action resolves would also help us resolve the wave count for Nifty. Currently we have shown here two wave counts of Nifty. The alternative wave count would mean that we assumed as the wave (4) might in fact be wave 2. This alternative wave count would only be confirmed if prices break and sustain above the downward sloping trend channel very soon.

In absence of any such move we continue to operate under the assumption that we may be in the process of wave (5) topping out and we may still have a major correction. Hence every possibility remains that we may at least attempt a re test 7600 levels (24930 on BSE Sensex), may be deeper. But considering the fact that the cost of being wrong here would mean getting caught short in a major rally on break of the trend channel. It would be best to not initiate short positions in the market.

In times of conflict & confusion, it is best to stay aligned to larger trend for the core portfolio and avoid trading positions until the trend is clear. The larger trend for Nifty is up. Hence corrections should be seen as an opportunity to add to the portfolio.

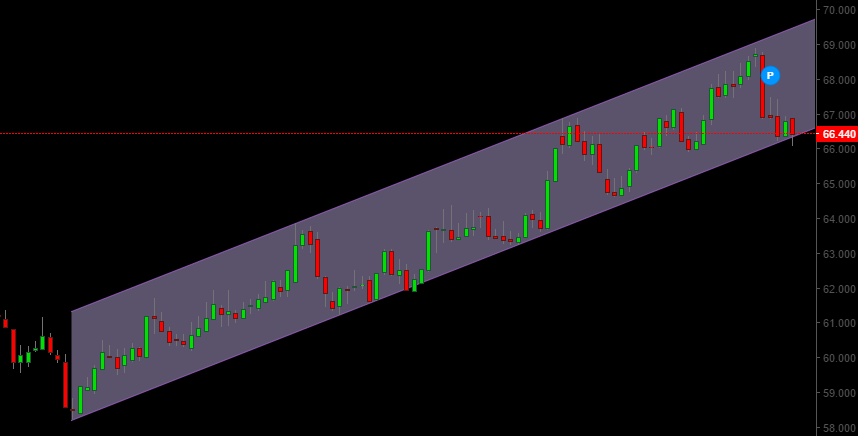

Our post on USDINR also mentioned how prices trade near the bottom of the crucial trend channel that has been in play since May 2014. More importantly we mentioned that it would be prudent to wait for break of 65.83-65.93 to confirm a break of this channel. On the upside we awaited break of 66.87-66.90 to see if the prices attempt a travel back up to the upper end of the channel.

Since then USDINR rally halted near 66.90. At the same time the prices traveled to 66.10 but failed to break below our crucial levels (65.83-65.93). These levels should be continued to be watched closely, specially on the downside. We believe it is highly likely that the upward break of trend channel in Nifty/ BSE Sensex & downward break of trend channel in USDINR should happen around the same time.

To end with a little tongue in cheek humor:

Mr. Shashi Tharoor recently remarked in the parliament that rupee has now crossed Prime Minister Modi’s age. A break of the trend channel would in fact make it very likely that USDINR would fall below even Mr. Tharoor’s age (60).