NIFTY

Nifty rallies by 300 points on our call. Detailed Analysis

In our last post on Nifty we said: “The price developments so far are positive. They appear to be impulsive in nature and not corrective. This is a very positive development and odds remain high that we may have in place a medium to long term bottom. The markets though may enter […]

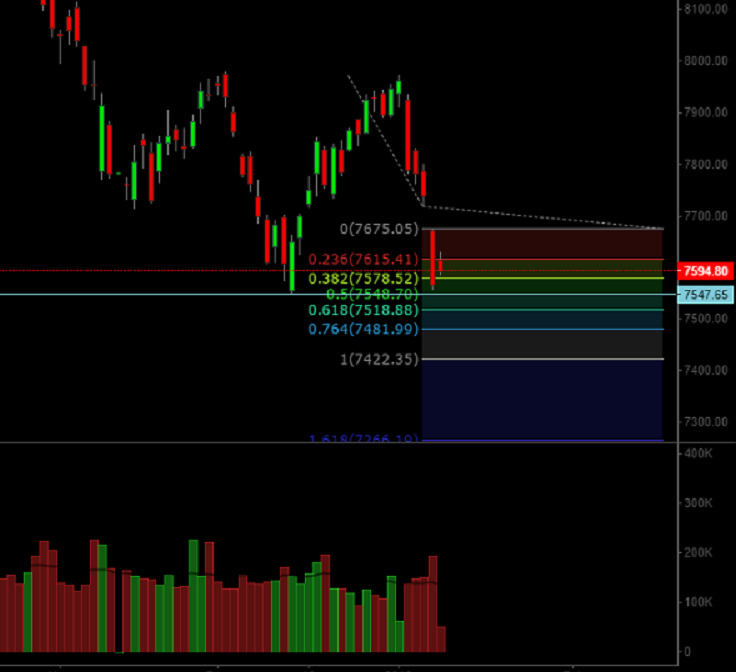

Nifty, Gold, U.S. yields technicals & Fed meeting

Our 21st January market end report pointed out to a reversal in the market with an immediate price target of 7580-7630 for the ending diagonal pattern. The trade is currently in play. Meanwhile we present a medium term chart outlining a high probability wave count for the correction this market […]

Nifty: Possibly Ending diagonal pattern completion today

Nifty opened gap down 80 points and ended sharply lower today down by over 1.5%. At one point it was trading down close to 200 points, but ended up recovering some losses by the day end. We have been tracking this pattern for few days now, but this pattern requires […]

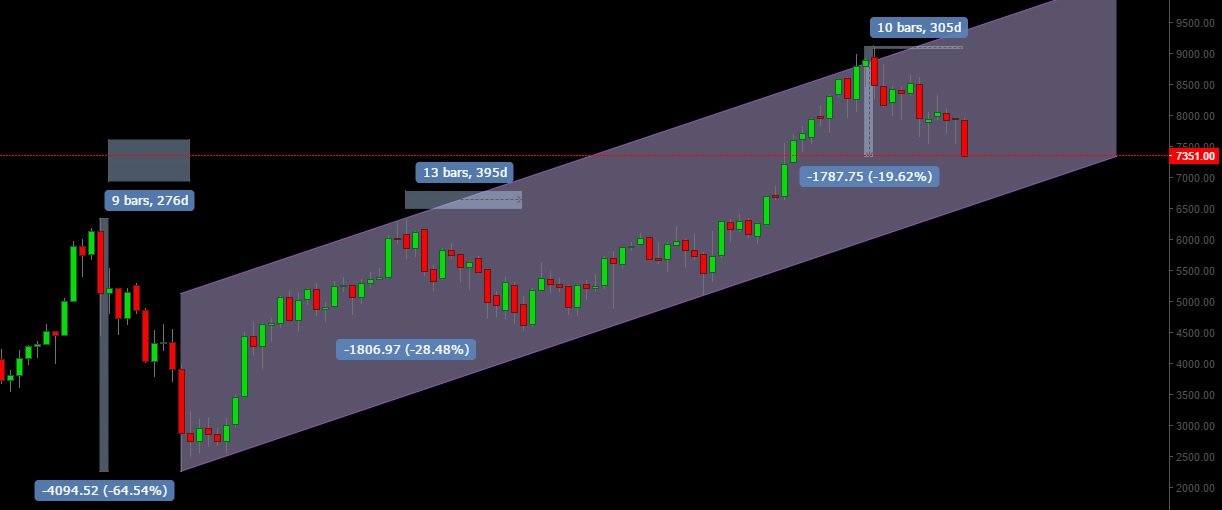

Market Crash: Is this like 2008 all over again?

With respect to Nifty’s fall, a lot of comparison is being drawn to the kind of crash we saw in 2008. So we decided to pick up the monthly chart to actually compare this fall with what we saw in 2008 and a later correction we witnessed in 2010-11. Chart […]

Nifty Short term Update

Short term Update Nifty opened lower yesterday and has managed to close the opening gap formed yesterday. Markets managed to bounce from 7494. The price structure looks corrective, but considering the volatility we recommend getting out of your short trades if markets cross 7633. The shorts can continue to target […]

Nifty: Potential for further fall but has strong support to break

The swiftness of Nifty move anticipated in our last report played out well, with global markets extending further sell out. The swiftness of the move and increased volatility means it would get increasingly harder to trade these moves. The gap down like these only further adds to the confusion, as […]

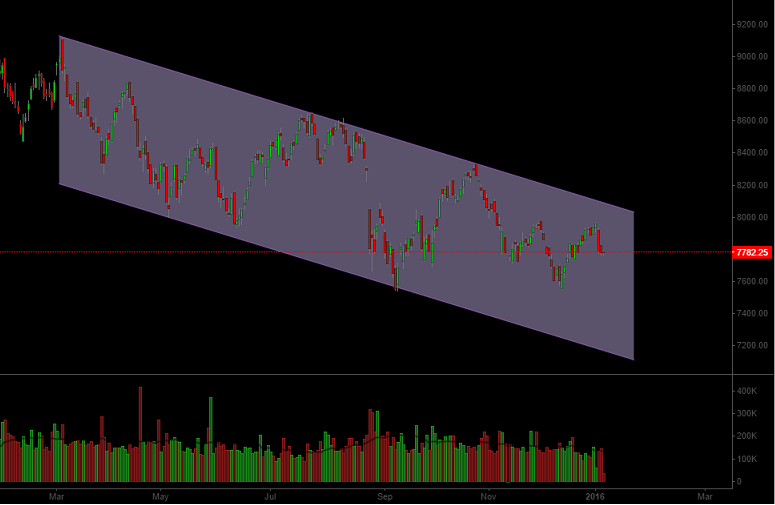

Nifty: More pain likely

In our last post we mentioned: “It would be wise to not consider the current rally to be the beginning of a sustainable bull market unless we see some concrete developments above the trend channel. There is every possibility we may still see a sharp reversal and fall in the […]

Nifty rally may continue in the short term

The stock market movement post the Federal reserve rate hike has been an anticlimax. The markets have refused to go below the Modi Era support range although they did manage to briefly test it. We believe it is still advisable to stay cautious on the long side, as the price […]

Sensex & Nifty: Brace up for something spectacular!

Nifty & Sensex selling to continue for the short term as we move closer and likely enter the Modi Era Support Range, but this article is for medium term and long term investors as we will soon be entering an important juncture in the market, which could turn out to be […]

The one Nifty trend channel you must observe closely

In our last report we pointed to a short term channel that was being followed from 7714 lows formed on 16th November. We also mentioned how the upward price movement had lacked to exhibit the right price action for a sustained up-move. We also mentioned and we quote: “You see […]