Crude Oil

2017 Financial Markets Forecast

Around this time last year as well, the US Fed hiked interest rates. At the time they expected 4 more rate hikes over the year. We had grave doubts over this hawkish commentary materializing, simply because the pattern in interest rate yield charts didn’t support the view, and yet this […]

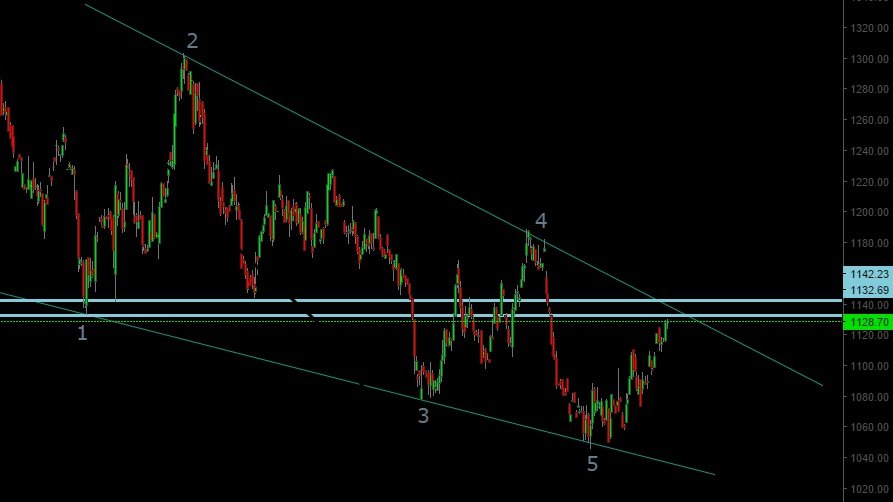

Gold’s Next move: Crucial Level To decide

Our regular readers would remember how we have been bullish on Gold since December of 2015 (Refer: Can Gold shine in 2016?). The precious metal has not disappointed, meeting our initial target of $1330 right after the Brexit poll outcome. Right now Gold is placed close to an important level which […]

Nifty Post Brexit Strategy

Nifty’s sharp fall on Brexit outcome took support at 7936. It managed to stay over the crucial support of 7896 mentioned in our Nifty medium term wave count report. This report mentions 7896/7715 as crucial support in determining our most preferred wave count. We will continue to watch these levels closely. […]

Gold 2016 Target Revised!

Our December 2015 report on Gold: Can Gold Shine in 2016? gave a bold bullish call on Gold in the back drop of extremely bearish sentiment on the precious metal. In the report we clearly mentioned that our 2016 target for Gold is $1343. In less than 3 months the prices hit a high […]

Gold: Not even 2 months and here we stand

Our mid-December Gold report clearly laid out what was coming for the commodity in 2016. In what looked like an unlikely rally to most, it has rallied 5% since. So far the story has worked out as we expected. But now comes the real test for Gold prices as it reaches […]

Nifty, Gold, U.S. yields technicals & Fed meeting

Our 21st January market end report pointed out to a reversal in the market with an immediate price target of 7580-7630 for the ending diagonal pattern. The trade is currently in play. Meanwhile we present a medium term chart outlining a high probability wave count for the correction this market […]

Can Gold shine in 2016?

Can Gold shine in 2016? In order to answer this question we are first going to look at what is prevalent in the news media recently: Dec 10: Dow Jones Business News says Prices edge lower as bearish sentiment prevails Dec 10: The week points out: Bets mount that price will […]