Crude Oil

2017 Financial Markets Forecast

Around this time last year as well, the US Fed hiked interest rates. At the time they expected 4 more rate hikes over the year. We had grave doubts over this hawkish commentary materializing, simply because the pattern in interest rate yield charts didn’t support the view, and yet this […]

Nifty: Is all hope lost?

Nifty broke through the key 8655 level, yet has failed to sustain above the level for too long. Also another attempt to move above the T1 trend line failed. Chart Below: The 8530-8535 levels in Nifty is key. If Nifty manages to stay over these levels, there is every possibility that […]

Nifty Post Brexit Strategy

Nifty’s sharp fall on Brexit outcome took support at 7936. It managed to stay over the crucial support of 7896 mentioned in our Nifty medium term wave count report. This report mentions 7896/7715 as crucial support in determining our most preferred wave count. We will continue to watch these levels closely. […]

EURUSD: Fate is sealed. Brexit or Not!

Here is the long term EURUSD elliott wave count: The wave count tells us that we are in a long term wave III down trend. Wave 3 within this wave was very close to 1.5 times the magnitude wave 1. The rally in EURUSD since 2015 is part of corrective […]

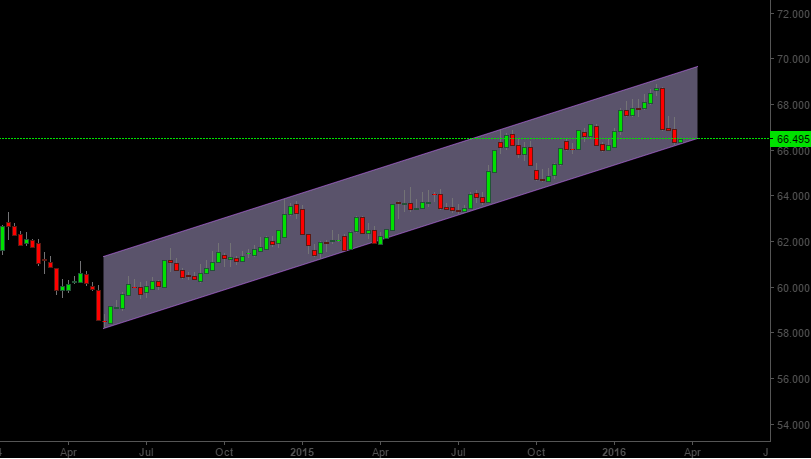

Crucial Week for USDINR

USDINR currency pair has been trading in a channel since May 2014. This channel has managed to hold on for quite a bit of time now. The latest peak created on 22-Feb failed to test the upper trend line of the channel, which is generally an indicator of weakening trend. […]

Dollar Index and USDINR

An ending diagonal triangle, or wedge as many call it, is a narrowing price move composed of two converging trend lines highlighting a wave 5 pattern. An ideal ending diagonal is reproduced below: We are likely seeing this pattern unfold on the dollar index charts (1-2-3-4-5 wave count in the chart […]

USDINR approaches make or break price

USDINR approaches make or break price range that would decide its trend for coming weeks may be even months. A break of this price range would signal bearish trend however if it manages to hold above these levels (which to us looks unlikely) the prices would likely test the 2013 […]