NIFTY UPDATE

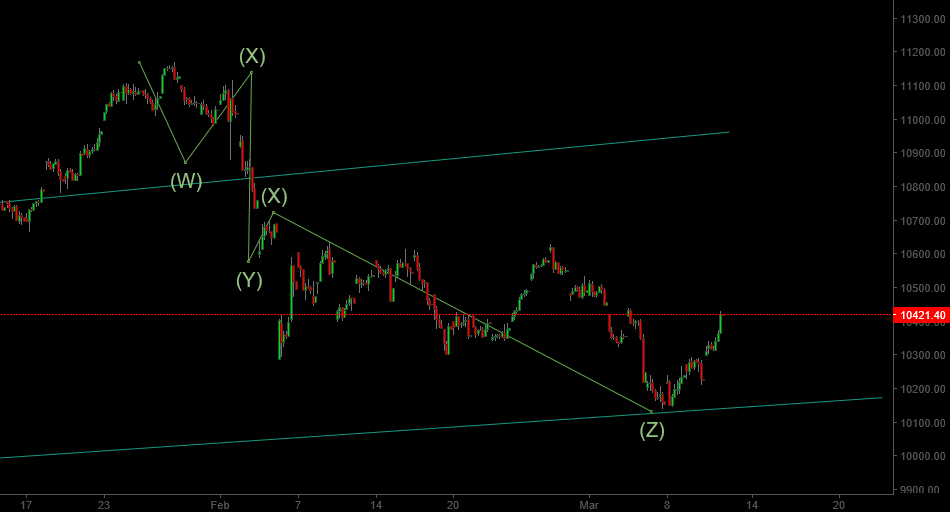

Nifty failed to sustain above the crucial 38.2% retracement level of 10604 and developed another leg down. This leg down though has not violated the important 10033-10075 zone mentioned in our last report. Below is the most probable wave count for Nifty’s fall from all time highs:

This is actually one of the 3 different wave counts we are tracking (2 of the wave counts are bullish, 1 bearish). In dealing with multiple wave counts it becomes crucial that preference be given to those counts which are in sync with the higher degree trend (which is up in this case). This is one of the reasons we are currently sticking to this particular count. Though as it happens even our bearish wave count is actually pointing out to further upside in the short term before any further fall. This implies in the shorter term we are likely to sustain the up move.

The crucial support level for short term is the minor gap area of 10296-10300. While for the long term we will continue to track 10033-10075. Though the price action on Monday is encouraging we would like to see the current up move develop as a 5-wave impulse wave followed by a 3-wave correction, before we can be confident that the worse in terms of the price fall is behind us. As our regular readers would recognize this is usually what we follow when we are dealing with multiple possible wave counts with no simple patterns in place.

On the upside important levels are 10534/10600/10703/ 10755 which can act as important resistance levels. Since our most bearish count also has the potential for seeing Nifty at 10755 level we are cautiously optimistic that the current rally may continue at least for some time.

BANK NIFTY UPDATE

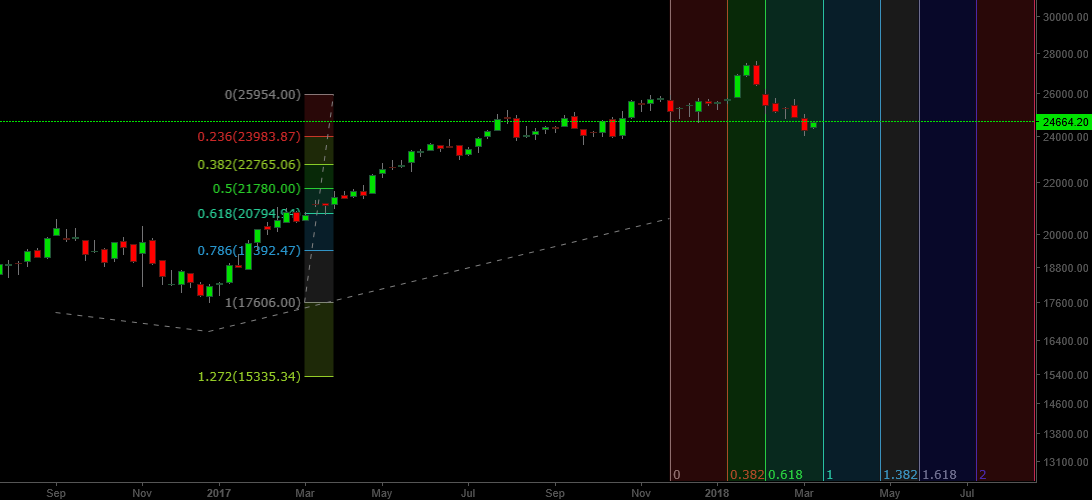

Interestingly Bank Nifty is showing similar price structure and is trying a bounce from a low of 24048. Chart below:

This low around 24048 is not very far from the crucial fibonacci level around 24000. Beyond this support level there is another important Fibonacci zone around 23790-23860, which would act as an important support level (not shown). The last time a correction of this magnitude (both time and price wise) was seen in Bank Nifty around Sep- December 2016. We have since seen a rally of around 57% in Bank Nifty from December 2016 lows. The Sep-Dec correction lasted for around 15-17 weeks. The current correction in Bank Nifty has been for a similar time frame (this being the 16th week). The news flow around December 2016 lows was similarly negative around the banking sector as it is today. All this strongly suggests that a bottom is either already in place for Bank Nifty or may soon be in place. So we should be prepared for surprises to the upside in Bank Nifty if there is no major violation of these levels.

If our analysis of Bank Nifty is correct we should see some kind of an upward move in Bank Nifty that may last possibly up for 6-7 months. All this gives us further reason to prefer our bullish wave count in Nifty as well.

NIFTY & BANK NIFTY OUTLOOK

We are approaching important levels in Nifty & Bank Nifty and while we are tracking multiple wave counts, we continue to prefer our most bullish counts for both these markets. Accordingly we will stay cautiously bullish for next couple of weeks as we may see the up move continuing. If we see this up move develop as a 5-wave up followed by 3-wave down price structure that doesn’t take out the lows, we can be sure that the worst in terms of price is behind us for now.