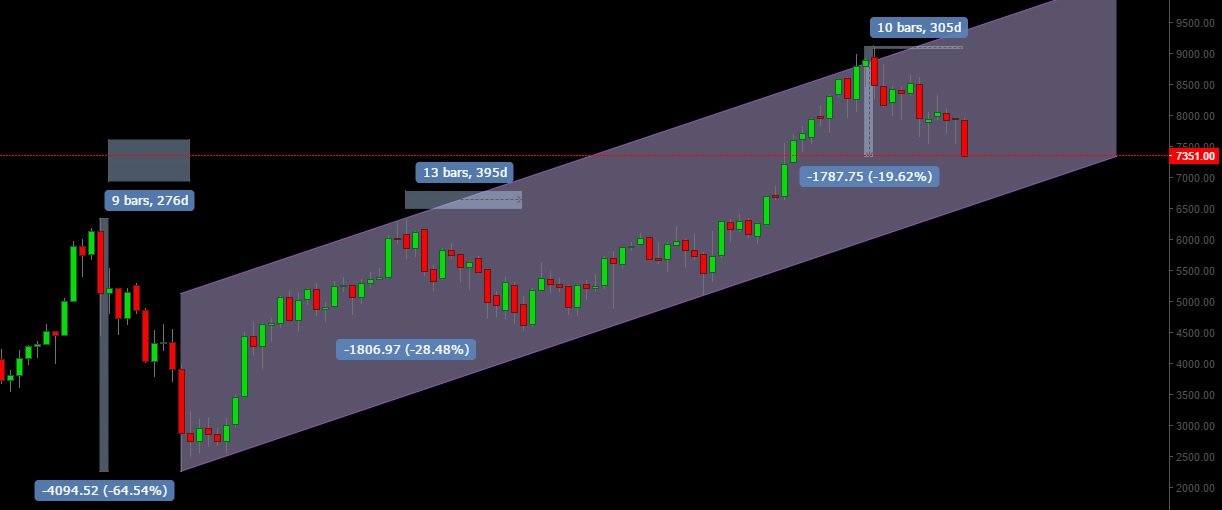

With respect to Nifty’s fall, a lot of comparison is being drawn to the kind of crash we saw in 2008. So we decided to pick up the monthly chart to actually compare this fall with what we saw in 2008 and a later correction we witnessed in 2010-11. Chart below:

This is a monthly chart, so here are some facts to glean from this chart:

2008 In 9 months Nifty crashed by 4094 points which is close to 65%. Rally began from the next month. But if u look closely one can also say that the market rally that began from the 14th month didn’t look back. So one can argue market was in correction for 13 months.

2010-11: In 13 months Nifty crashed by over 1800 points (close to 28-29%). Rally began from 14th month. So one can say that market stayed in correction for 13 months.

2015-16: This is the 10th month. Market has crashed by close to 1800 points (close to 19-20%).

Looking at this some analysts have said they expect markets to bottom out in April (which is when we complete 13 months of market fall) and by looking at 2010-11 percentage fall they are also expecting for markets to correct further. But, it is not uncommon to see the corrections to match in amplitude terms too rather than %age return terms. So some analysts (including us) feel that in terms of quantum of correction we are already in a zone where we satisfy the amplitude requirements of correction and we should be wary of expecting much lower levels. So, we should be careful about getting caught short in an un-expected rally.

While there is uncertainty about where this fall might halt, few conclusions look certain:

A. When compared to 2008 crash, the 2015-16 crash has only been a disappointment, specially if you look at distance market traveled in comparable time.

B. Also there seems to be more similarity of this fall with the 2010-11 fall rather than 2008 fall.

So is a 2008 like crash still possible? Sure It may happen, in the sense that there is very little limitation with respect to what cannot happen in the financial markets. But from what we have seen so far, it looks unlikely.

The key in times like these is how well you have managed your savings, and how well you have managed the money you have invested in the market. If you have not been too greedy so as to pour in you entire savings in the market (worse if you borrowed money to put in the market to make quick money), if you wake up tomorrow and see markets have hit the lower circuit, you would be disappointed but not destroyed. Some may even look at it as an opportunity. If not, there is unfortunately nothing but sleepless nights ahead till the market is out of the woods.