Blog Posts

Nifty breaks out providing confirmation

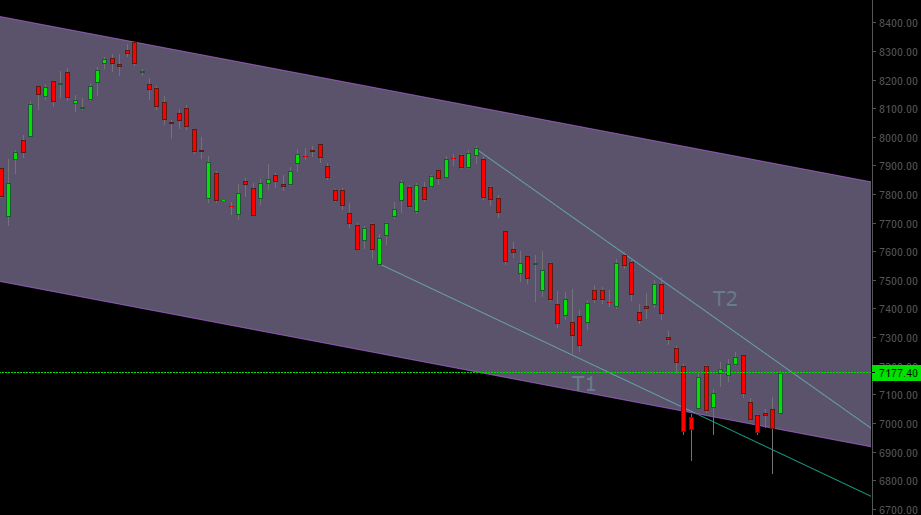

We have been tracking two trend lines for quite a few days now in hope of finding an important confirmation signal. The T1 line has reinforced its importance time and again with markets refusing to stay below this line for long. The market rally for two days meant that yesterday […]

What these Bhagvad Gita Quotes teach you on investing

Bhagvad Gita Quotes & Investing Here I share 9 Bhagvad Gita Quotes (in bold letters) followed by what they teach you on investing These Bhagvad Gita Quotes have been taken from various sources (Not Verified): Quote 1: “It is better to live your own destiny imperfectly than to live an […]

Nifty Whipsaw Budget Action

Nifty has seen a volatile whipsaw budget action, that has essentially brought the market back to where it started after posting a new low. Price are back into the corrective channel that has been play since March of 2015.It has also closed and managed to stay above the T1 line […]

Nifty: Markets evenly balanced

Much like the parliament, markets have seen a lot of drama without much progress. Nifty reversed from the key level of 7241 outlined in our last report. But significantly enough managed to stay above the low of 6960, thus still keeping the hopes for bulls alive. This is even more significant […]

Nifty Update

Our last article outlined a 2-stage confirmation required to confirm if a sustainable bottom is in place. The prices managed to break and stay above line T1 and are now trading close to an important resistance level 7241. Though the price action is not as convincing. In light of this […]

SEBI Registration Status

We are very happy to inform all our readers that our founder/ analyst Mr. Yash is now registered with SEBI as an independent research analyst as per SEBI (Research Analysts) Regulation, 2014 . His SEBI registration number is INH000002632. For the benefit of our readers we would soon be launching a […]

Nifty Triple ZigZag bottom confirmation awaited

In our last post we mentioned how some indicators have aligned but prices have not. The market action on Friday has given some indication of buying emerging as markets managed to stem and recover from the intra-day fall to close near the opening price of the day creating a Doji. […]

Nifty Market Update: Some indicators align, but not all!

Markets had one of the worst days since April ’15. The news articles in non-financial media reflect this fact: Snapshot from Times of India: Snapshot from Firstpost: Snapshot from Hindu: Snapshot from NDTV: If you have looked at these snapshots closely, you would feel something is wrong, and you would […]

Nifty likely heading for test of sub-7100 levels

Nifty has invalidated our high probability wave count and is now developing into the 5th leg as per our second most likely scenario outlined in our last post. This doesn’t affect our long term analysis (and bullish outlook) as the prices continue to stay in a channel since the price […]

Nifty: Can go long with stop below 7240

Consistent with our high priority wave count outlined in our last post, where by we have finished a 5-wave impulse move around 7600 and the correction from highs around 7600 is a wave 2 correction. One may consider going long around current levels of 7285-7315, with a strict stop loss […]