Author: Yash

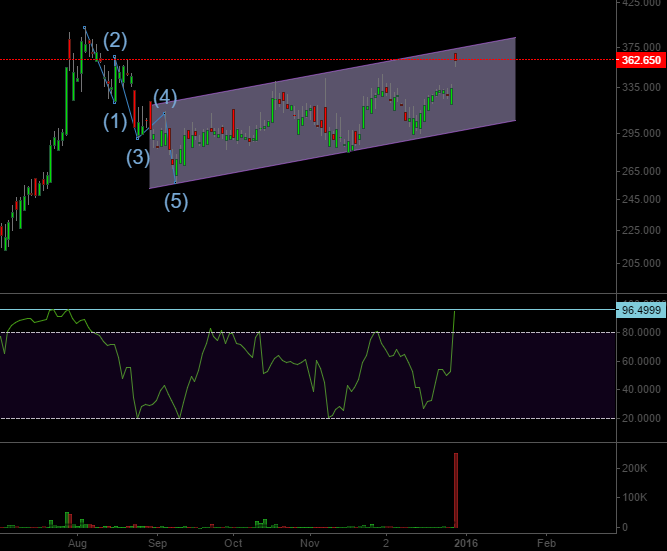

Divi’s Labs may present a low risk trading opportunity

We came across this chart today and would like to alert our readers to an impending trading opportunity in Divi’s Labs. The chart below shows a triangle formation in price charts. A triangle formation can be broken down into 5 legs and we are likely seeing the 5th leg in […]

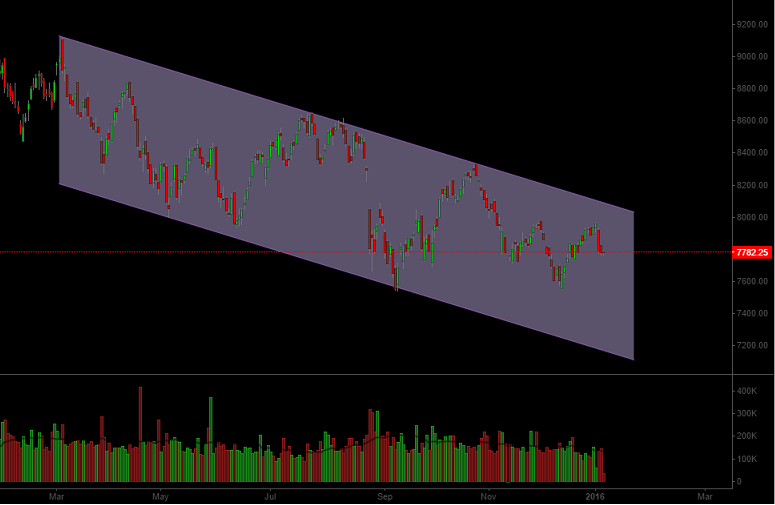

Nifty: More pain likely

In our last post we mentioned: “It would be wise to not consider the current rally to be the beginning of a sustainable bull market unless we see some concrete developments above the trend channel. There is every possibility we may still see a sharp reversal and fall in the […]

The market mover from 31st Dec you must watch out for

A debt free heavy electrical equipment company which happened to have rallied by 13% on 31st December 2015 with extreme volumes has managed to break out above its 52-week high of 839. The sales of the company have been under pressure specially over last two quarters. The charts of the company […]

Avoid these market movers from 29-December

We recommend you to avoid these market movers from 29-December: Salora International happened to move by over 13% on closing basis. It has seen a a major gap opening with extreme volumes. We urge you to avoid this stock as the move has likely exhausted itself (or is about to). […]

Nifty rally may continue in the short term

The stock market movement post the Federal reserve rate hike has been an anticlimax. The markets have refused to go below the Modi Era support range although they did manage to briefly test it. We believe it is still advisable to stay cautious on the long side, as the price […]

Is it the right time to invest in ELSS or equity mutual funds?

In this video we answer the question Is it the right time to invest in equity mutual funds? Welcome to our special report on Equity linked savings scheme or ELSS as it is popularly known. As you might be aware ELSS is a popular investment product because you can get […]

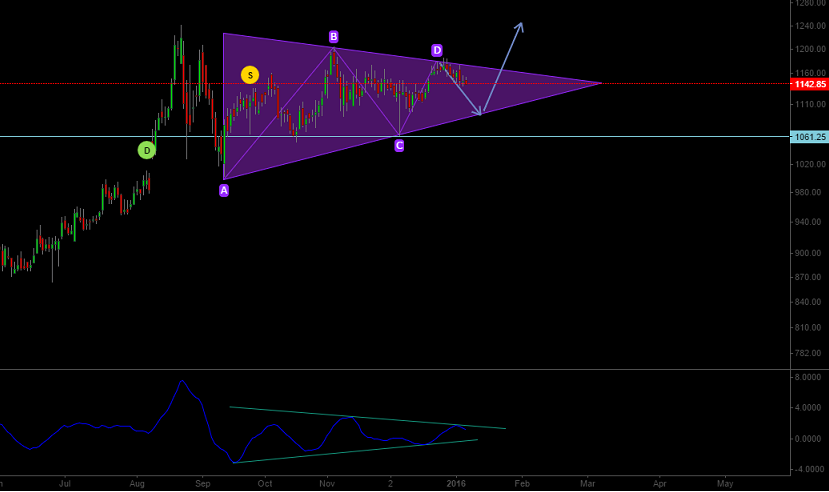

Can Gold shine in 2016?

Can Gold shine in 2016? In order to answer this question we are first going to look at what is prevalent in the news media recently: Dec 10: Dow Jones Business News says Prices edge lower as bearish sentiment prevails Dec 10: The week points out: Bets mount that price will […]

Sensex & Nifty: Brace up for something spectacular!

Nifty & Sensex selling to continue for the short term as we move closer and likely enter the Modi Era Support Range, but this article is for medium term and long term investors as we will soon be entering an important juncture in the market, which could turn out to be […]

The one Nifty trend channel you must observe closely

In our last report we pointed to a short term channel that was being followed from 7714 lows formed on 16th November. We also mentioned how the upward price movement had lacked to exhibit the right price action for a sustained up-move. We also mentioned and we quote: “You see […]

Dollar Index and USDINR

An ending diagonal triangle, or wedge as many call it, is a narrowing price move composed of two converging trend lines highlighting a wave 5 pattern. An ideal ending diagonal is reproduced below: We are likely seeing this pattern unfold on the dollar index charts (1-2-3-4-5 wave count in the chart […]