Author: Yash

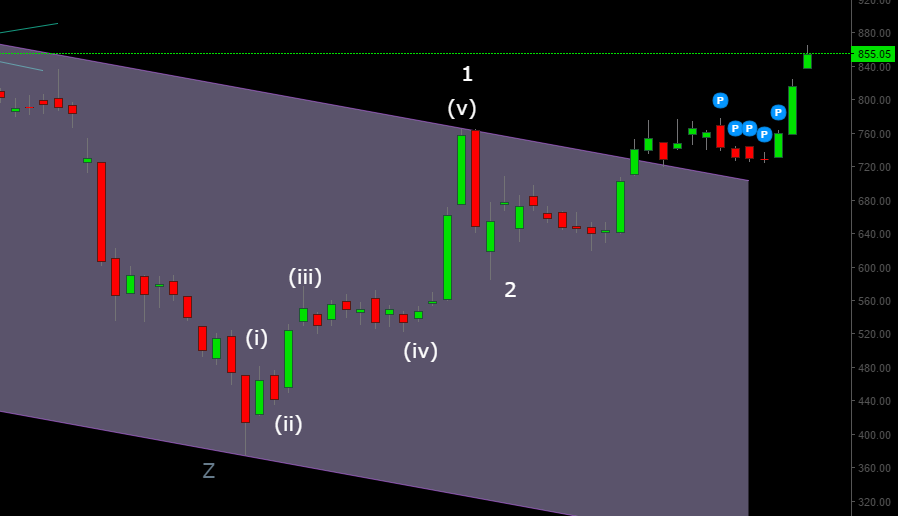

Just Dial: Power of Wave Analysis in dealing with incomplete data

Just Dial got listed only around second half of 2013. Which means trading data is only available since. This makes the data set incomplete as far as application of elliott wave analysis is concerned. But if you can get hold of basics, you can still find ways to make profitable […]

Nifty & Sensex Update

Markets have seen a sharp correction from 7784 levels (25479 BSE Sensex). The prices have respected the trend channel that has been in play since March ’15. This was the correction we have been expecting that should mark the end of wave 1 & develop into wave 2 correction as per […]

Trader TV covers Indian Insight

Indian Insight was recently covered by Trader TV. I was asked about my experience as a trader, my motivation behind starting IndianInsight.com. I also talk about some of our upcoming courses & services. You can watch the interview here:

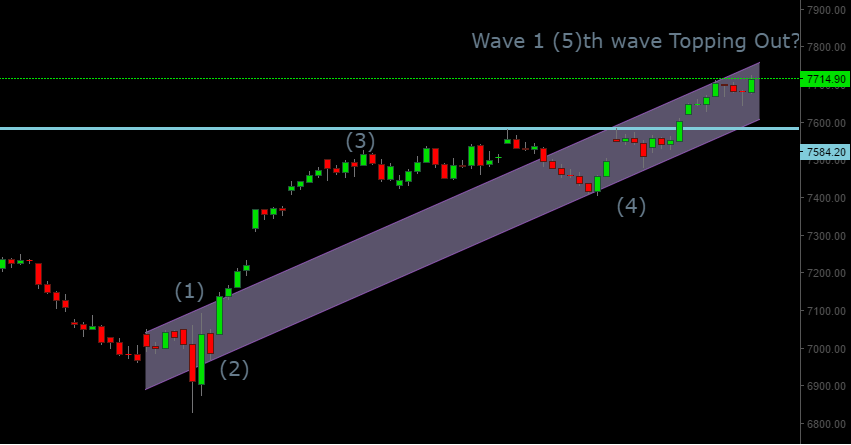

Nifty, BSE Sensex, USDINR End of the week Update

Nifty & BSE Sensex have encountered resistance at important levels. We mentioned in our last post how 7745 & ultimately 7800-7820 (upper end of the trend channel) may be important levels for Nifty. We saw markets crash sharply from 7745 & equally sharp rally back, markets pulled back from 7777 […]

Gold 2016 Target Revised!

Our December 2015 report on Gold: Can Gold Shine in 2016? gave a bold bullish call on Gold in the back drop of extremely bearish sentiment on the precious metal. In the report we clearly mentioned that our 2016 target for Gold is $1343. In less than 3 months the prices hit a high […]

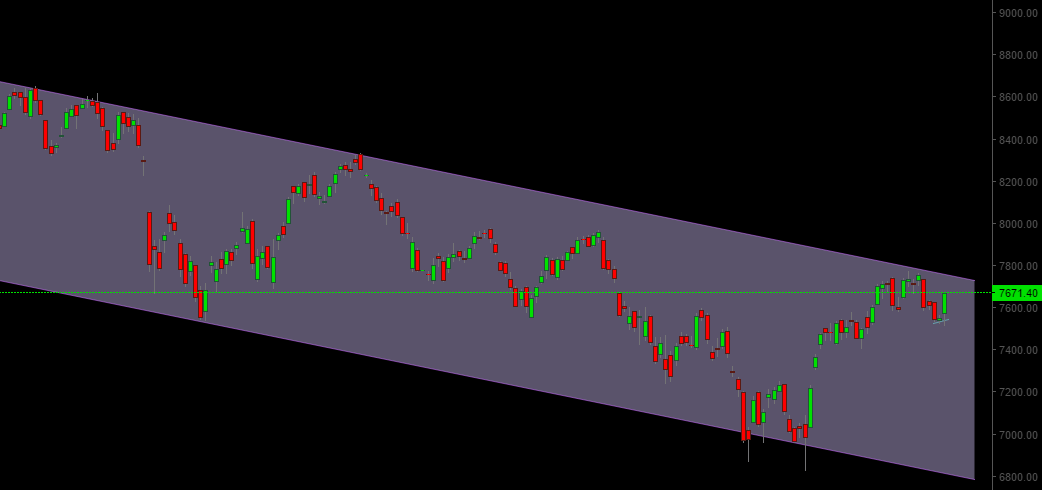

Nifty: We are at a critical juncture

Lets first present our medium term chart for Nifty. This chart shows the trend channel that has largely contained the correction in Nifty from 9100 highs in March of 2015. As you can see in a little more than three weeks we have traversed from lower trend line to the upper […]

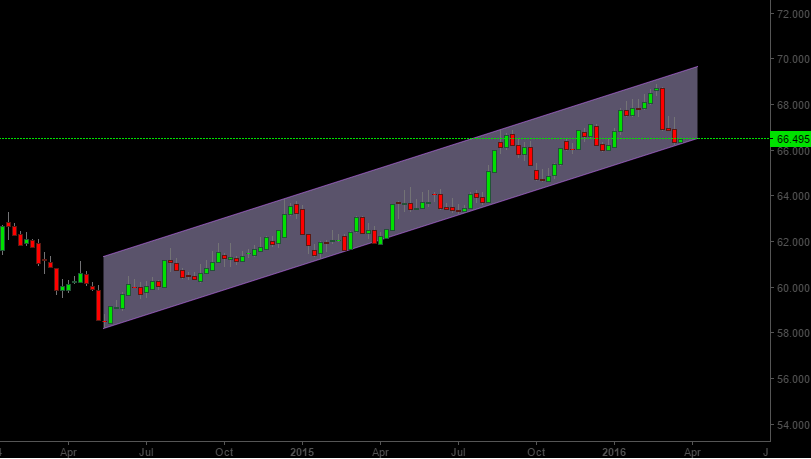

Crucial Week for USDINR

USDINR currency pair has been trading in a channel since May 2014. This channel has managed to hold on for quite a bit of time now. The latest peak created on 22-Feb failed to test the upper trend line of the channel, which is generally an indicator of weakening trend. […]

Nifty Short Term Update

Nifty broke above the crucial 7541 levels but failed to sustain above it as it sharply reversed its gains after hitting a high of 7582. A break of of 7461 level on the downside should be used to exit any initiated long positions as it may indicate an extended correction […]

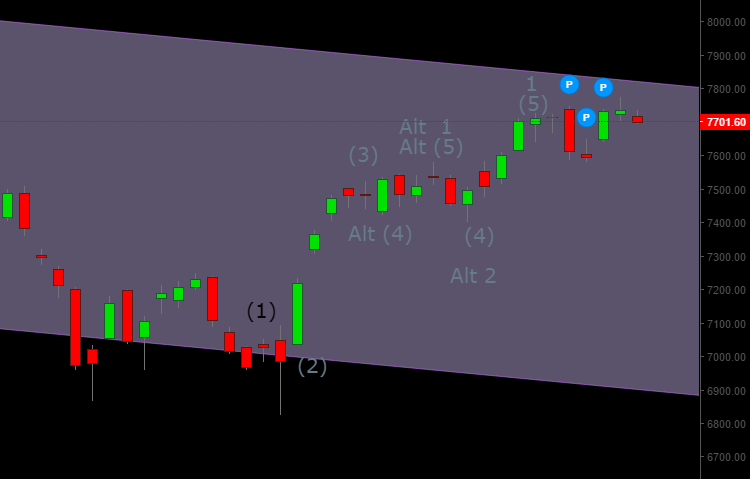

Nifty Congestion Breakout Awaited

For the last few days, Nifty has been trading in a congestion zone of 100 points. The last correction of this magnitude in Nifty played out intraday on 29-Feb. This was a wave 2 zig-zag correction as shown in the chart below. Current congestion is likely part of wave 4 […]

MCX Crude / NYMEX Crude approach Make or Break Zone

Once in a while markets approach levels that have the capability to define the trend for the market for coming weeks or months. Something similar seems to be happening in crude oil as it approaches an important zone which may provide a decisive hint to the the next major trend […]