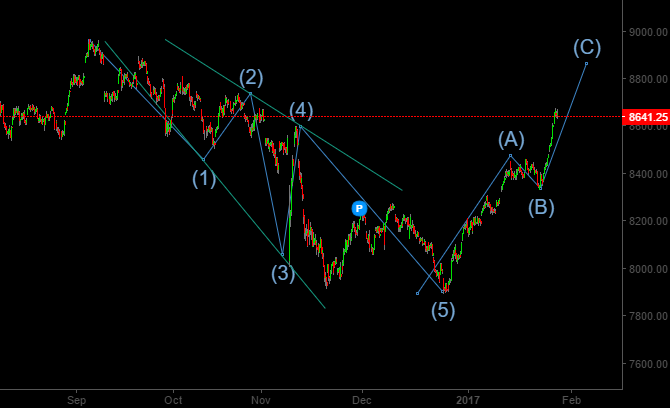

Nifty fell from a key level outlined by us, but failed to develop an impulse move to the downside. This resulted in a major rally that may have substantial implications. Below is a probable wave count for the fall since September. We were considering this to be a low probability wave count so far. Since then Nifty has managed to cross an important zone, so we cannot further ignore this wave count. This is also the most bullish wave count for Nifty as it suggests that the worst may be over for Nifty:

We placed low priority for this wave count largely because of the expanding nature of the W-X-Y-X-Z structure (triple zig zag corrections are often contained within a trend channel). We are still not convinced on this wave count. But, if the market manages to break above the September highs (possibly during the budget) then this would be a valid wave count. In this scenario we may likely see the rally extend much further.

Here is a probable bearish wave count on Nifty:

As per this wave count we may have completed a 3-3-3-3-3 expanding leading diagonal around 7800. This has been followed by a probable zig-zag A-B-C correction. We may currently be operating in Wave C. The completion of Wave C may imply a move towards (and below) 7800. Unfortunately this wave count can’t be completely discarded until we break the September highs.

Based on both these wave counts, we expect that the current rally may extend further. In the short run the important measured target zones are 8740-8760 and 8876-8910. Important short term support levels are at 8480/8333.

In the current scenario we are unable to pinpoint the next major move with high degree of confidence using Elliott Wave Theory. This is where one needs to show patience & wait for the price action to clarify itself. This is in spite of the possibility that we may witness a major post budget rally. Experience has taught us to limit ourselves to those scenarios where we can operate with high degree of confidence. If the market is indeed poised for a major bull run then it would be so strong that we could still catch substantial returns after the breakout.

If you are still not done with your tax saving Section 80C ELSS investment, it would be wise to make one part (say around 1/3rd) investment before the budget & the remaining investment after the budget. In case you witness a major post budget rally that sustain-ably breaks over the Nifty September highs of 8950, you should go ahead with your remaining investments because it is likely that the move may sustain. If however we witness a post budget correction then you may delay your remaining investments to March. Remember, even if we enter a bearish scenario where we break down below 7800 and possibly much lower, from a long term perspective we are still in a bull market. On a 2-3 year horizon we are likely to witness a 5-digit Nifty value in either scenario.

In case of individual stocks your strategy should depend on the wave counts operating in the stock. It would be prudent to operate in stocks with clear wave counts as they may continue to move in their individual trend whether or not we enter an extremely bullish or bearish scenario. Also remember that stock specific wave counts should get precedence over outlook of broader stock market indices.