In April I shared a post on Just Dial: Power of Wave Analysis in dealing with incomplete data. To quote from the article:

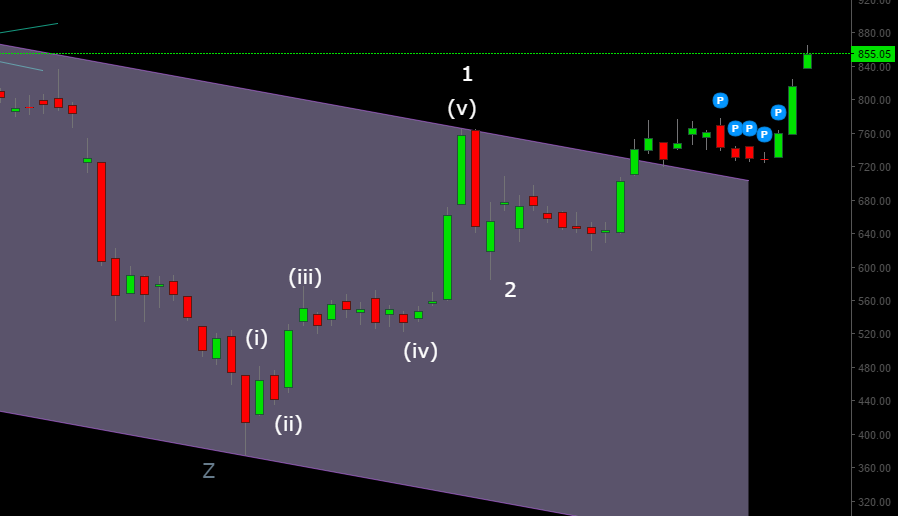

Once prices bounce off the lower end of this trend channel and develop a 5-wave upward move of lesser degree. This is a clear indication that we may have a case for a sustainable up trend.

The trade entry worked out beautifully as Just Dial posted a brilliant rally. To quote more from the article I wrote:

The prices have rallied in a 5-wave upward sequence completing wave 1. Prices corrected right from the upper end of the trend channel in a wave 2 . The prices may now be trending as part of a wave 3 up move which is likely given how easily prices broke through a trend channel which had held for 18 months. As part of wave 3 though the prices should be able to hit 1170 (assuming our analysis since the lows is correct). The price action needs to carefully watched for developments that may prove our analysis wrong

The question one may ask is how does one know if the wave count is wrong. With the help of this example, let me demonstrate how you can check if there may be something wrong with your working wave count.

We will start with our working assumption at the time. We said that we may have completed wave 2 and are probably rallying up as part of wave 3. If we are assuming we are in a wave 3 rally then there are some expectations from the price performance of a wave 3 rally. For instance wave 3s are usually the strongest waves. This implies that in terms of amplitude they are expected to materialize into a much bigger rally as compared to wave 1. Often the amplitude of wave 3 is between 1.5-1.618 times wave 1 (It may well exceed these targets, but in a impulse move you won’t find wave 3 to be less than wave 1 in amplitude).

On the other hand sub-moves in an A-B-C correction may often tend towards equality or certain other fibonacci ratios. So for example Wave C may often be around 0.786 times or 1.23 times or equal to wave A. So if you have a confusion as to whether you are witnessing an impulse move as part of wave 3 or if this move is part of wave C, you should always keep an eye on whether an impulse move develops in the opposite direction around these points. You likely won’t see any such developments if you are in a wave 3 as the strength of such waves is very strong.

Over an above wave 3s often contain extensions, this is often to ensure that wave 3s meet or exceed the measured amplitude targets compared to wave 1s and leave enough room for wave 4 corrections to develop without overlapping wave 2 corrections. This ensures that one of the basic Elliott wave rules of wave 4 not entering the price territory of wave 2 is not violated.

Getting back to Just Dial chart below:

Here we see the following developments:

- Some resistance develops around the .786 measured level. This alone is not worrisome unless we see an impulse wave also developing in the opposite direction.

- We see an expanding diagonal, followed by a correction followed by another fall which breaches an important level (shown by a horizontal line). This in itself is a big red flag because if we were to break our supposed wave 3 into sub-legs one may mark this level as end of wave (iii) within 3 or wave 1 of (iii) within 3. In order to meet our measured target we needed an extension to develop and the test of this level considerably reduces the probability of this development.

- The test of the level was followed by another correction which also resolves to the downside, thus completing a 1-2-3-4-5 impulse move to the downside.

Ultimately we saw a downward impulse wave develop around the .786 level which puts a major question mark on our wave count. This 5 -wave impulse development was followed by an upward correction, which is an opportunity to close your position to preserve your profits.

Incidentally, in case of Just Dial we were dealing with incomplete data & we ended up with an incorrect overall wave count and yet one would have pocketed anywhere between 40-60% returns in a space of 3-4 months.

Disclosure: Just Dial was bought by me in February (in tranches) and sold in May, as per the analysis presented here. I have no current position in Just Dial.