Lets first present our medium term chart for Nifty. This chart shows the trend channel that has largely contained the correction in Nifty from 9100 highs in March of 2015. As you can see in a little more than three weeks we have traversed from lower trend line to the upper trend line of the channel.

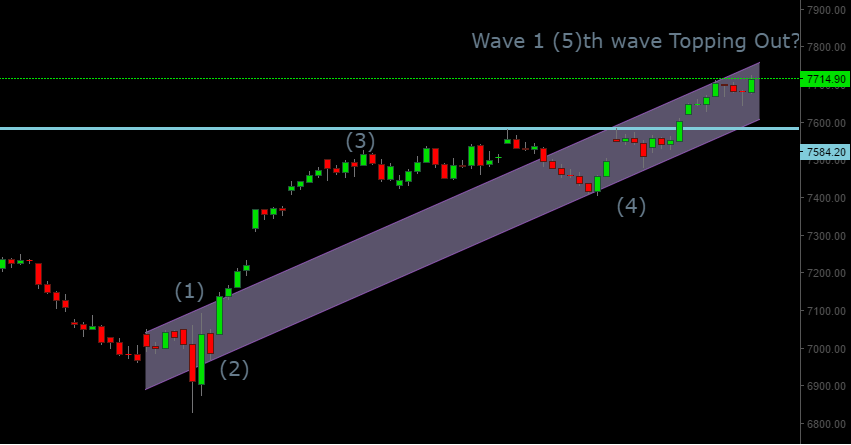

Now lets have a closer look at the move from around 6830 levels. This is the 120 mins chart:

As per our wave count we are likely in the (5) leg of wave 1 of this rally from 6830. Hence we may be in a mature stage of this rally. As per Elliott Wave Theory what follows after a 5-wave impulse movement is a corrective movement. Hence once the final leg runs out, we should expect a substantial correction in the markets. The amplitude of this correction should be more than the amplitude of correction we witnessed in either wave (2) or wave (4). In fact we may expect the markets to retrace at least 38.2% of this current rally, may be more. The targets of course would be determined based on where wave (5) ends and also based on the price action, that follows end of wave (5). As per classical Elliott Wave Analysis, we may anticipate a zig-zag correction or a flat (a)-(b)-(c) correction (as part of wave 2 of higher degree) to follow this 5-wave rally.

As for the wave (5) through different calculations we may still see a rally towards 7745 or ultimately up to 7800-7820. 7800 level is also where the medium term trend channel may tentatively meet the market. Any upward breakout of the medium term downward channel is likely to be a false break out and hence should be treated with skepticism. The possibility of the Nifty rally (towards 7800) though will be ruled out in case the market breaks the 7582 levels before achieving any of these levels/ testing the upper end of the trend channel.

The ensuing correction after end of wave (5) of wave 1 may bring skepticism towards the spectacular rally from 6830. There may also be overwhelming market commentary that may suggest we are in a bear market. This would be a perfectly normal wave 2 crowd behavior. It may be a very costly mistake to believe this. Instead this fall should be used by people who have missed the current rally in order to build / add on to their portfolio.

We should remember that we have achieved a lot with this rally from 6830 levels. For one it signals that the correction from March 15 has probably ended. Also since we have seen a clear cut 5-wave development on the upside, we have got the first confirmation that we have essentially begun the next leg of the bull market. The ensuing correction will be an acid test for this rally. The basic rule of Elliott wave theory is that wave 2 correction following wave 1 should not go beyond start of wave 1. Hence once the wave 2 correction completes we would be in for a major rally that would be much bigger than the current rally we may have witnessed from 6830 levels.

Some stocks with strong charts though may present divergence from this correction by rallying strongly even in face of this correction. This would of course depend on the price action of individual stocks. There are some stocks for example which have actually managed to post substantial positive gains even throughout the market fall.

In case you are looking for advice on your investment in a particular stock, you can now get an analysis by placing an order here. There is a small fee charged for this service.

One thought on “Nifty: We are at a critical juncture”

Comments are closed.